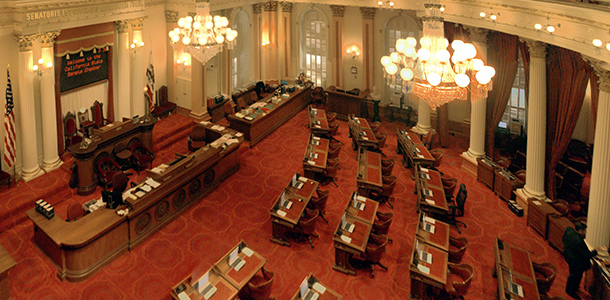

(Photo Credit: Wayne Hsieh/Flickr)

With more than a dozen major tax measures moving through the Legislature or toward the November 2016 ballot, California’s perennial debate about taxes is set to begin anew—with millions of dollars in political campaigns preparing to shape how the state will raise billions of dollars in revenue, and provide public services, for years to come.

In a report released today, From revenue to results: Considering today’s tax proposals, CA Fwd aims to broaden this pivotal conversation, encouraging Californians to look beyond how much money each measure would raise and who would pay—and to consider the proposals’ combined fiscal, governance, and policy impacts, as well. After providing a detailed look at this year’s major tax ideas, the report defines a set of criteria for assessing their strengths and weaknesses—and outlines what a tax system that meets the criteria might look like.

“With filing deadlines for ballot measures approaching—and with tax changes likely to stay on the table for several more years—Californians have a political window, and a rare opportunity, to do more than increase taxes and spending,” says Jim Mayer, president and CEO of CA Fwd. “Civic leaders have a real chance to advocate for a better revenue system—one that fairly, adequately, and efficiently supports our highest priorities, from schools and the safety net to the state’s deteriorating infrastructure.”

In the first two parts of its Financing the Future series, CA Fwd explored how this could be done—highlighting the tough fiscal decisions posed by the coming expiration of Proposition 30’s temporary taxes (Chapter 1) and identifying a range of revenue and governance changes that could allow communities to invest in the workforce and infrastructure California needs to thrive (Chapter 2).

From Revenue to Results, the third installment of the series, focuses on this year’s emerging tax proposals, many of them moving toward the November 2016 ballot. After providing a summary of today’s tax system, the report explores the biggest active ideas for changing it, from broadening the sales tax base to services and extending Prop 30 to updating the assessment system for commercial and industrial property. The report also highlights a number of smaller-scale measures that would tax tobacco, oil, and marijuana, along with ideas for raising money for infrastructure and providing more revenue authority to local governments.

Will these changes move California toward a better tax system?

This is the central question raised in From Revenue to Results, which outlines a set of criteria voters can use to assess these tax proposals. While the report highlights how much each measure would raise and how the funds might be spent, the criteria pose questions about how well each proposal meets generally accepted principles of taxation—from promoting fairness and fiscal stability to encouraging economic growth—as well as how well they support state policy goals.

In the coming weeks, CA Fwd will be asking fiscal experts and civic leaders to score the current proposals against the criteria to determine whether these changes will move the state toward a better tax system—and how these ideas might be strengthened.

“The criteria may be controversial, and they will—and should—be debated,” says CA Fwd’s Mayer. “But more importantly, the criteria can move the conversation beyond polling results to improving public services. Financing the Future encourages Californians to think as citizens about these important issues: How do we spread the tax burden fairly, how do we encourage job growth—generating stable revenues for families and government? How do we boost the chances that government paid for by the people will deliver better results for the people?”

And how, ultimately, can the state build a tax system that achieves these goals? From Revenue to Results offers some ideas, but to do tax reform right, more will be needed. Civic leaders will have to join this conversation—and to develop their own vision for a lasting revenue system.

The political window is now open, but it may not stay that way for long.