(Photo Credit: NIOSH/Flickr)

As the housing policy debate escalates and various solutions are proposed, costs become an inescapable topic of discussion. Linkage of construction wage standards to streamlined residential project approvals processes quickly became a particular focus of attention in 2016. We argue that it is unlikely that elevated wage standards could have major impacts on total housing costs, given that construction labor comprises only 14 percent of total California housing costs. The preponderance of academic research on prevailing wage standards[1] cost impacts has found no significant overall impacts on the construction of nonresidential structures.[2]

Misconceptions about construction labor are prevalent in the public sphere. We have prepared a two-part post that covers (1) construction labor in the overall cost picture of the multi-family housing sector and (2) the question of whether the workers building new housing will themselves be cost-burdened and require housing subsidies in the absence of policy intervention.

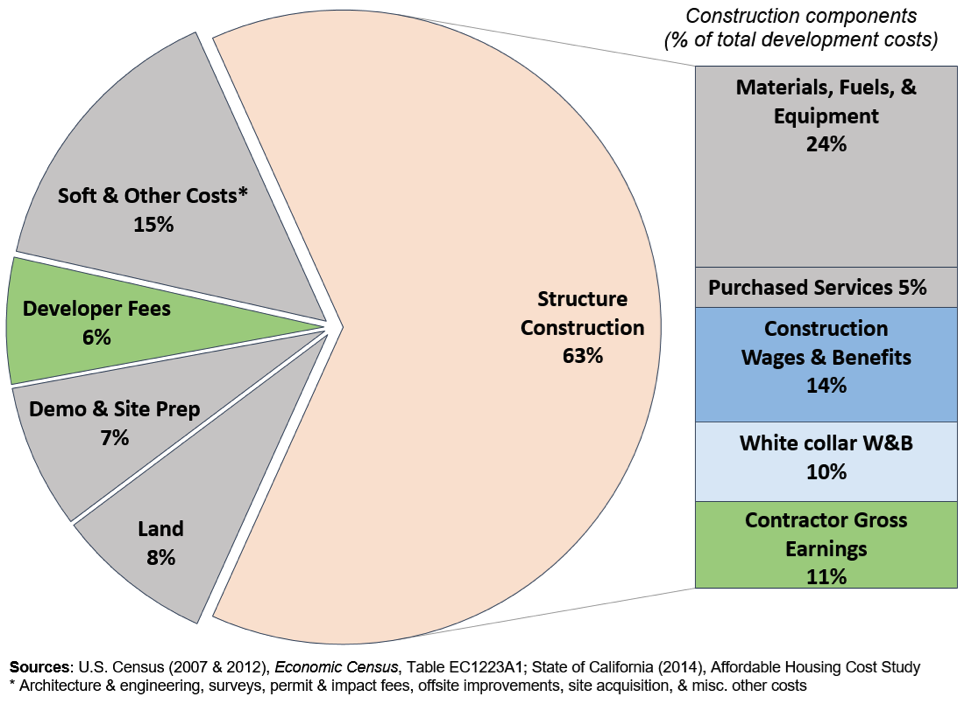

The pie chart featured in this post presents the cost structure of California multi-family housing development. It is derived from two highly credible sources: the State of California’s 2014 Affordable Housing Cost Study[3] (AHCS) and Economic Census data specific to California’s construction industry.[4] While this is a snapshot of the residential building industry, changes over the past generation show a clear divergence between the costs of construction and distribution of the value it generates. Since 1992 the construction industry’s gross operating surplus, the basis for profitability, has increased 50 percent more than either materials or construction labor, according to the Economic Census.[5]

Using these data we find the following:

- The largest cost components, comprising 29 percent of total project costs, are the materials, fuels, equipment, and purchased services required to build the structure.

- Contractor earnings and developer fees[6] together account for at least 16 percent of a project’s total costs. Because developer fees are capped by the regulations of the California Tax Credit Allocation Committee, the source of the project cost data, it is reasonable to expect developers of market rate projects to demand higher fees.

- Soft & other costs, which includes architectural & engineering services, acquisition & finance costs, off-site improvements, and permitting and impact fees comprise another 15 percent of total project costs,

- Construction wages and benefits average approximately 14 percent of total project costs, just under 22 percent of the total “hard cost” of the structure.

- White collar wages & benefits account for 10 percent of project costs. White collar workers comprise approximately 30 percent of the construction industry’s employees but account for more than 40 percent of its payroll.

- Demolition and site preparation expenses, which are broken out separately from building costs in the AHCS, make up 7 percent of costs.

- Land, on average, accounts for 8 percent of an below-market rate project’s costs according to the AHCS[7], however this is among the most variable of expenses. High demand coastal markets routinely see much higher land cost shares for both affordable housing and market rate projects.

Given the evidence above, it is clear that (1) construction labor costs are far from the determining factor in overall housing costs and (2) the industry has room to absorb wage increases for the men and women building the housing California desperately needs.

READ PART 2: The 1,000,000 Homes Challenge: Will workers who build new housing be left housing cost-burdened?

Alex Lantsberg, AICP, is research-analyst and Scott Littlehale is senior research-analyst for the Northern California Carpenters Regional Council, which includes 24 local unions throughout the 46 Northern California counties that represent tens of thousands of construction worker households.

Comments? Questions? You can email the authors at alantsberg@smartcitiesprevail.org and slittlehale@nccrc.org

[1] Prevailing wages are minimum wages and benefits paid to construction workers on publicly supported construction projects that are determined based on the rate paid to the greatest number of workers in a particular craft and region where the work is performed.

[2] Research on California housing costs that use standard statistical methods report prevailing wage project cost impacts of 9-12 percent. Littlehale (forthcoming) analyzed the ACHS dataset and estimates prevailing wage costs of only half that magnitude. Other drivers of costs, such as inefficiencies of scale, are greater.

[3] The AHCS is an empirical housing development cost study intended to measure the factors that influence the cost of building affordable rental housing in California and forms the basis the cost breakdown for the major project cost components such as structure, site preparation, and soft costs, permitting, impact, and developer fees, and other costs related to particular projects (elevators, parking, public meetings, etc.).

[4] “The Economic Census is the U.S. Government's official five-year measure of American business and the economy,” according to the United States Census Bureau. Together with the AHCS, Economic Census data allow us to understand the entire cost structure of housing and the firms building the housing. We averaged the 2007 and 2012 Census of Construction for this analysis due to the particular conditions the industry found itself in during the survey years. In 2007 the housing bubble put the entire construction industry (NAICS 23) at full capacity and at peak profitability with $216 billion of business, however in 2012 the industry just began to recover, doing only $148 billion in business, a 31 percent decline. Multifamily housing (236116) declined from more than $3.6 billion in business to just under $2.6 billion, a 28 percent decline. Our construction labor share estimates are weighted averages of both multifamily residential contractors and specialty trade contractors.

[5] We examined average BCCW trends in comparison to various construction industry price indices tracked by the Federal Reserve; in every instance BCCW wages increased less than the price index.

[6] Because a sizable number of the BMR projects are done by non-profit developers we assume here that the developer fee is intended to cover the specific administrative expenses associated with a project without room for profit.

[7] The AHSC had an average per-unit land price of $24,000 and only one project with land costs in excess of $100K per unit in in its 2010-2012 database. By 2016, the $100K/unit threshold has become common in the Bay Area for affordable housing projects. As an extreme example for market rate projects, KB Homes paid $470K/unit for an .76 acre fully entitled parcel in San Francisco.