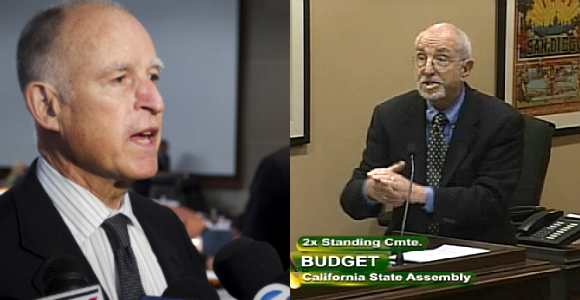

Gov. Jerry Brown and Fred Silva of California Forward (right) have provided testimony supporting creation of a California rainy day fund. (Photo Credit: Charlie Kaijo/Flickr and CalChannel)

UPDATE – Thursday, May 15, 2014

And just like that, it’s in voters hands. Today both houses of the California Legislature unanimously approved a new bipartisan rainy day fund, sending the constitutional amendment to the November ballot, where voters will have their say.

California Forward received praised from the Assembly floor before the legislation was passed, with Asm. Jeff Gorell thanking the organization for its “early work” on the subject—and noting that the final measure has CA Fwd’s “fingerprints on it.”

CA Fwd released a fiscal reform package in 2009 that included a proposal for better managing the state’s revenue to insulate critical programs from revenue volatility. During negotiations on this year’s proposal, CA Fwd highlighted a “hybrid” approach for crafting the reserve that became the framework for the final agreement.

Legislative leaders from both parties praised the final measure this week: Republican Assembly leader Connie Conway called it “one of the most important bills we’ll pass this year.” Former Assembly Speaker John Pérez, the bill’s author, called the final product “a genuinely bipartisan proposal” that “will help put California on a solid fiscal footing.”

“We’re happy to have informed the deliberations and to have provided options that were incorporated into the final solution,” said Fred Silva, CA Fwd’s senior fiscal advisor. “We are grateful for the bipartisan leadership that helped solve a significant problem with a meaningful answer. Now we look forward to helping voters understand—and support—this important measure in November.”

ORIGINAL POST – Wednesday, May 14, 2014

California Forward testified today before two budget committees in support of the bipartisan rainy day fund legislation that was the centerpiece of a deal between the Governor and legislative leaders announced last week. The new budget reserve, which is projected to create a rainy day fund of about $4.6 billion by 2018, includes two key features recommended by CA Fwd in an April report: a mechanism for capturing spikes in revenue and a system for making consistent deposits to the reserve to ensure funds are available during economic downturns.

CA Fwd emphasized the importance of both elements in an Assembly budget committee hearing two weeks ago—supporting an initial proposal made by the Governor and Assembly Speaker (which focused exclusively on capturing spikes in capital gains revenue), while also calling for “more regular, reliable” deposits to the reserve.

This “hybrid” approach became the framework for the agreement announced last week—with legislative leaders from both parties celebrating an agreement to capture capital gains realizations in excess of 8 percent and set aside 1.5 percent of General Fund revenue each year.

“Democrats and Republicans have come together to create a rainy day fund that ensures we’re not only saving for the next downturn, but also paying off our debt,” Gov. Brown said last week. “We’re headed for deficits again unless we do something very different,” he added this week when unveiling his revised budget—calling the new reserve “fundamental” to the state’s fiscal sustainability.

In testimony before the Senate and Assembly budget committees today, CA Fwd reiterated how important it is to manage spikes to end the cycle of boom-and-bust budgeting that has crippled the state’s fiscal system over the last decade—and caused billions in cuts to state programs. The bill was passed unanimously out of the Assembly Budget Committee and is scheduled to be heard on the floor Thursday, with the Senate expected to follow suit. The constitutional amendment would then be placed on the November ballot for voter approval.

“We’re happy to have informed the deliberations and to have provided options that were incorporated into the final solution,” said Fred Silva, CA Fwd’s senior fiscal advisor. “We are grateful for the bipartisan leadership that helped solve a significant problem with a meaningful answer. We encourage lawmakers to move this legislation quickly so voters can have their say in November.”

The hybrid solution

In its testimony, CA Fwd highlighted how the new rainy day fund will stabilize the state’s fiscal system by ensuring spikes in revenue are not used in ways that unsustainably increase the state’s fiscal commitments. In previous economic booms, lawmakers have used one-time resources to lock in revenue reductions or spending increases in ways that have exacerbated the state’s budget difficulties when the economy declined. This short-term thinking has hampered social service programs, in particular—and weakened the safety net for the most vulnerable Californians.

The hybrid solution, as former Speaker Pérez put it in today’s Assembly hearing, “will help us break the bad habits of the past.”

The mechanics of this approach:

- Managing spikes: In the last 15 years, the state has had six years where revenue from capital gains realizations exceeded 8 percent of General Fund tax revenue. Transferring revenue from capital gains in excess of this amount would have resulted in an average annual deposit during those years of $2 billion into the BSA.

- Making consistent deposits: By transferring 1.5 percent of General Fund revenue annually, the measure will ensure consistent deposits into the reserve for the next downturn. Looking again at the last 15 years, the state would have made this transfer about seven times depending on budgetary decisions—contributing an average of $1.3 billion in the non-recession years to the reserve. What will these transfers look like in the years to come? The May Budget Revision projects roughly $1 billion per year being deposited in the BSA, which would bring the BSA balance to about $4.6 billion by the end of 2017-18.

- Addressing suspensions and withdrawals: Just as important as the mechanism for putting money into the reserve are mechanisms for suspending contributions and determining when withdrawals can be made. The measure ensures deposits during times of revenue growth and withdrawals during times of economic slowdown.